Introduction

After the October 7th attacks on Israel in 2023, perhaps the only thing more shocking than the attacks themselves was American left-wing activists’ almost immediate insistence that the Palestinians were the true victims. Their hysterical accusations that Israel was committing a genocide in Gaza spread like wildfire throughout American media and, most notably, American universities. Commentators quickly began to speculate as to what—or who—was behind this propaganda.

One country emerged as a focal point for those concerned with the spread of pro-Hamas propaganda in the United States: Qatar.1 The Qatari government has donated billions of dollars to American universities and think tanks over the past two decades, a fact that has attracted periodic criticism but rarely the level of scrutiny it garnered by the end of 2023. Six American universities established branch campuses in Qatar throughout the late 1990s and early 2000s. And Qatar provided each of these universities with subsidies in the tens of millions every year to operate these campuses. They additionally provided faculty at those universities with millions more dollars in research grants.2

The National Association of Scholars (NAS) published Outsourced to Qatar in 2022, a case study detailing the extent of Qatar’s influence operation at one of the six American university branch campuses run by Northwestern University’s School of Journalism.3 Our case study showed the scale of Qatar’s financial investment and how its influence led to compromises on freedom of expression to appease Qatar’s authoritarian government. In the same year, we also exposed tens of millions of unreported Qatari funds to the Texas A&M University System.4 Our reporting, along with the work of others, created sufficient pressure for Texas A&M University to announce that it would close its Qatar branch campus in February 2024.5 This was an unprecedented decision at the time, but we hope that other universities will follow suit.

Yet, only a few years ago, the extent of Qatar’s influence was unknown. The major source of information about foreign influence in higher education, the Section 117 database of foreign gifts, was poorly maintained and woefully incomplete. For instance, by 2017, Texas A&M had reported $131 million in Qatari funds. That might sound like a lot, but after the U.S. Department of Education (ED) investigated underreporting of foreign funds in 2020, the number of reported funds from Qatar to Texas A&M rose to over $600 million. And, crucially, reported funds from Qatar to Texas A&M prior to 2017 in the new data totaled $244 million—almost double what the university initially reported.6

Even after the ED’s investigation, universities have continued underreporting foreign funds. The ED did not claim to have conducted a full audit of the database and sounded the alarm in its report that the Section 117 database was incomplete. Soon after, the Biden administration closed the investigations into foreign gift reporting, and little has been done since.

At the NAS, we believe the flow of foreign money from adversarial countries into our universities threatens national security and the academic freedom required for an intellectually stimulating collegiate environment. To this end, we have spearheaded major investigations into Chinese Communist Party-run Confucius Institutes at universities.7 Prior to publishing this report, we exposed close to $1 billion of underreporting of foreign funds from China, Qatar, and Russia by comparing Section 117 data with data from public records requests.8

The database of foreign gifts described in this report represents our attempt to scale up this process. The current administration’s unwillingness to enforce the law led us to file more than 100 public records requests with public universities and state agencies nationwide to obtain a list of their foreign gifts and contracts since 2010. Universities were not always happy to share this information with us: along the way, institutions stalled, inflated cost estimates, and claimed bogus exemptions that we successfully appealed.9 We eventually obtained either partial or complete information on foreign funds from more than 70 universities, the union of which composes our database.

While limited to a smaller set of universities, our database exceeds the Section 117 database both in scope and detail. We report gifts whose value are below the federal reporting threshold of $250,000. We report donor names and the purpose of the gifts for most items in our database—information that is missing for the vast majority of funds in the Section 117 database. Most importantly, our database contains previously unreported funds that should have been reported under federal regulations.

Our database serves two main purposes:

- It provides journalists, policymakers, and other interested members of the public greater transparency about foreign funds to American universities. Our database is easily searchable and contains more information about each donation than Section 117.

- It serves as a model for lawmakers for what an improved version of the Section 117 database ought to look like. The current Section 117 database is insufficient to provide the sort of transparency about foreign influence it claims to offer. But if lawmakers can meet—or exceed—the level of information contained in our database through an amendment to the Higher Education Act, government officials and the public can more easily identify and combat harmful foreign influence.

In this report, we provide further details about the nature of the database and its contents. We provide some basic instructions on how readers can use the database. We also discuss some broad findings about foreign funds reporting that emerge from carefully comparing certain portions of our database to Section 117 data. These findings illuminate just how significant the underreporting problem was prior to the ED investigation and how the underreporting of foreign funds has continued under the Biden administration. We also discuss the importance of the reporting threshold, and how much more information might be gained from lowering it. Finally, we provide the following recommendations for policymakers to improve foreign funds transparency in higher education:

- Make donor names visible to the public

- Make each gift’s purpose visible to the public

- Regularly audit a random sample of universities for foreign funds disclosure compliance

- Penalize universities that fail to disclose their foreign funds

A Brief History of Section 117

Universities must report contracts, gifts, and grants they receive from foreign countries to the U.S. Department of Education (ED) under Section 117 of the Higher Education Act of 1965 (HEA). Section 117 was added to the HEA in the 1986 amendments to address concerns about rising foreign influence on college campuses. Under Section 117, all foreign funds from a given donor that total at least $250,000 within a calendar year must be reported. This includes gifts that pass through affiliated entities such as university foundations.10

Universities mostly ignored these disclosure requirements for decades. In 2019, the ED under the Trump administration launched an investigation into underreporting of foreign gifts, focusing on 12 major research universities. By 2020, the ED had found that universities failed to report more than $6.5 billion in foreign funds to the federal government, primarily from authoritarian countries such as China and Qatar.11 As a result of these investigations, the ED clarified guidance to universities on foreign funds disclosure requirements and built an online portal to make the data more readily available to the public. But significant problems remain.

Many universities have still failed to report funds received prior to the 2020 report. Donor names are missing for most funds, as well as the purpose of each gift. And in the summer of 2024, the portal was inexplicably shut down due to a “contract change.”12 As a result, Americans do not know the full extent to which universities benefit from foreign funds, what those funds support, and which foreign governments influence our universities.

The NAS Foreign Funds Database

The NAS foreign funds database contains foreign-sourced gifts, grants, contracts, and tuition payments to over 70 public universities and affiliated state agencies, beginning as early as 2010.13 We filed more than 100 public records requests at public universities and state governments across the country to obtain this information. Our database contains the following variables:14

|

Variable |

Definition |

|---|---|

|

OPEID |

Unique identification number for universities created by the Office of Postsecondary Education (OPE), an office within the federal Department of Education (ED).15 Users can use this identifier to merge our data with other ED databases. |

|

Donation ID |

Unique identification number for each transaction, created by NAS |

|

Contract ID |

Identification number for contracts created by the university16 |

|

School |

Institutional recipient of foreign funds |

|

State |

Institutional recipient’s location |

|

Country of Origin |

Foreign country in which the donor is based17 |

|

Donor |

The name of the entity from which the foreign payment originated |

|

Source |

Indicates if data comes from the ED or the National Association of Scholars (NAS) |

|

Receipt Date |

The date when the university received the foreign payment |

|

Award Start Date |

If applicable, the date when the contract associated with the foreign payment became active |

|

Award End Date |

If applicable, the date when the contract associated with the foreign payment was, or will be, terminated |

|

Transaction Type |

Indicates if item is a contract, gift, or student tuition payment18 |

|

Amount |

The dollar amount received by the university |

|

Title |

The title of the project associated with the funds, or a brief description of the funds’ intended use |

|

Description |

Brief description of the funds’ intended use |

We have also included all funds reported to the Department of Education’s Section 117 database.19 The ED used to provide this information on its own portal, but it was phased out in June 2024.20 Users can still obtain the data through downloadable files on the ED’s website, but we include them in our portal for easier accessibility.

Key Differences Between the NAS and Section 117 Databases

|

ED Section 117 Database |

NAS Database |

|---|---|

|

Only funds $250K and above |

No funding threshold |

|

Donor names rarely provided |

Donor names almost always provided |

|

Purpose of gift rarely provided |

Purpose of gift almost always provided |

Section 117 of the Higher Education Act only requires universities to report foreign funds with monetary value greater than or equal to $250,000 in a calendar year. Our database reports funds that are as small as $1 for many universities, and for those where we are limited by a threshold, our thresholds are typically much lower ($50,000 or $100,000, most commonly). We also provide donor names and describe the purpose of the funds for many universities in our database.

Including gifts with lower dollar values is important because malign foreign actors can often purchase influence for less money than one would expect. A University of Maryland professor, for example, accepted a $125,000 research grant from Chinese technology company Alibaba to help build China’s surveillance state.21 We found several items well below the $250,000 threshold from the Qatar Foundation, a state-led non-profit,22 which went to institutions such as Columbia University, Mississippi State University, and Western Michigan University.

Perhaps the most frustrating limitation in the Section 117 database was the lack of donor names for most gifts. While Section 117 provided this information when the donor was a foreign government agency, the relatively clear private-public distinction that we are accustomed to in the United States is not so in more authoritarian countries. The Chinese government, for instance, has significant influence over supposedly private companies that operate on its soil, such as ByteDance.23 Donations from ByteDance would not be flagged as originating from the Chinese government, but this does not mean they are not a vector for Chinese Communist Party influence.

Higher education lobbyists have historically opposed foreign donor name disclosure by claiming that it would dissuade future donations.24 Similar motivations underlie public records exemptions for donor names in several states, which impeded us from obtaining complete information from many schools.25 While domestic donors' desire for donor anonymity is understandable, mitigating foreign influence at our universities is more important than the right of foreign nationals to donate anonymously to American universities.

Therefore, we included donor names for as many gifts as we could obtain in our database. Our research has shown that knowing donor names is important for identifying unreported gifts and correctly identifying countries of origin. For instance, unmasking the donor identity of a reported 2021 gift to the University of South Dakota from the Cayman Islands shows that the Chinese company ByteDance was the donor. Yet because ByteDance is incorporated in the Cayman Islands, Section 117 users would have incorrectly assumed that this gift would not be a potential instance of Chinese influence. It turns out that the gift was part of a $9 million donation campaign from ByteDance to ten American universities, of which only the University of South Dakota reported funds.26 All of these donations are contained in our database.

Providing donor names would also assuage misplaced concerns over certain foreign gifts. Not all foreign gifts represent unwelcome attempts by foreign governments to influence American students and faculty. The University of Arizona, for instance, entered a contract with the United Kingdom-based organization Waltham Petcare Science Institute (previously Waltham Centre for Pet Nutrition) in 2019.27 Waltham Petcare Science Institute focuses on animal care research, and the contract with the University of Arizona was on the “Roles of Oxytocin and Vasopressin in the Psychobiology of Human-Animal Interaction,” a project that is unlikely to be a vector for malign foreign influence. Unmasking donor names and providing the purpose of each gift assures the public that benign gifts are actually benign.

We also provide the purpose of each gift in our database when available, unlike Section 117. Having the purpose of each gift publicly available in a centralized database allows for more efficient identification of potentially harmful donations. Under the status quo, where purposes are rarely provided, a researcher generally needs to check each donation against press releases and sometimes file public records requests to assess the donor’s intent. With the purposes provided, researchers can easily search the database for gifts that are intended to support specific functions, such as Confucius Institutes or foreign branch campuses.

How to Use the NAS Database

Users can filter results based on country of origin, donor, school, transaction type, and data source. Users can also select the number of variables that appear in the database by clicking the “Columns” button and selecting which variables they’d like to see on the webpage.

Users can access the foreign funds data in two ways. The first is by using our online portal—this is best for searching for individual donations. Viewers can also download the entire database to conduct data analyses. Download buttons are found at the top left corner of the database. One spreadsheet contains items in the ED’s database, and the second spreadsheet contains all items obtained by the NAS.

Limitations of the NAS Database

The Section 117 and NAS datasets should generally be analyzed separately. We cannot guarantee comparability between the two datasets due to reporting restrictions the NAS encountered when obtaining information. Combining data from Section 117 and NAS will result in duplicate amounts, as some funds will appear in both. Removing these duplicates is generally not possible at scale because the way universities subdivide their contract payments or calculate payment amounts may differ across the databases.

The NAS database represents our best attempt to obtain more complete information on foreign funds at public universities. It is, to our knowledge, the only data source of its kind that goes beyond the ED’s database. However, due to differing state public records laws and university record retention practices, we cannot guarantee complete coverage of all foreign funds to universities in our database, particularly in earlier years.

Analysis of the NAS Database

Working within the limitations of our database, we construct reasonably comparable samples of our data and the Section 117 data and analyze their relative coverage of foreign gifts. We do this by focusing on the period between January 1, 2010, and December 31, 2022, which is the period for which we requested data in our public records requests. We limit the Section 117 comparison data to the universities covered in our database. We then standardize the “transaction types” across the two databases. Our database specifies when a transaction is for student tuition, while Section 117 often reports tuition under the “Contract” or “Restricted Contract” categories, mixed in with research grants and other unrelated funds. Because we cannot reliably identify tuition in the Section 117 data, we treat tuition as a “Contract” in our data as well and group our data and Section 117 into two transaction types for the purposes of merging: contracts and gifts. We also standardize country names across the two databases, and we remove any funds that derive from US-based organizations.

We do not merge the two databases at the transaction level. Transactions may be reported differently across the two databases: a contract may be reported as a single entry in one and split into multiple payments in another. Instead, we collapse both databases to the school-country-year-transaction type level and merge. Though this produces many comparable observations, our database sometimes lacks items reported in Section 117 because of public records exemptions, retention policies, and recording errors.

Some of the analyses below rely on identifying donations in our database that are “reportable” to Section 117. To determine reportability, we check whether a donation meets the $250,000 threshold established in Section 117. This is not as simple as checking whether each transaction exceeds $250,000; rather, we sum all transactions by donor name within a calendar year and school, and check whether the total amount exceeded $250,000. If yes, then all the component transactions are considered reportable.28 We follow an analogous procedure when analyzing the consequences of lowering the reporting threshold.

Findings

Within the comparison sample, we find that compliance with Section 117 regulations was relatively high during the Trump administration but was low both before and after. While it is unsurprising that compliance was low prior to the Trump administration, given the findings of the ED investigation, the rapid return to underreporting during the Biden administration is concerning. It suggests that a continued commitment to enforcement will be required to ensure foreign funds transparency going forward.

Figure 1 summarizes the results for our sample. Under the Obama administration, starting in 2010, the Section 117 database reports $1.8 billion in foreign funds across the universities in our sample. However, we find $3.9 billion in reportable foreign funds in our database during that same period, more than double what is reported in Section 117. In other words, the underreporting problem is not just a minor underestimate; it halves the actual amount of foreign funds over $250,000 received by universities. Even worse, this is still an underestimate of underreporting, since our database has significant limitations in coverage at certain universities.

During the four years of the Trump administration, universities in our sample suddenly increased their Section 117 reporting to a staggering $4.7 billion, well exceeding the $3 billion in our database for that same period. This discrepancy is likely caused by limitations in our database as well as potential back-reporting of earlier gifts by universities under investigation by the ED. However, this shows that enforcement matters: the Section 117 database appears to be much more complete under an administration that took enforcement seriously.

The Biden administration does not appear to have continued this commitment to enforcing Section 117. Soon after Biden took office, the ED shut down its investigations into the underreporting of foreign gifts. Our database shows that this change sent a clear message to universities, which reported only $1.6 billion from 2021 to 2022 to Section 117 but should have reported at least the $2.6 billion in our database.

|

Presidential Administration |

Total Reported to Section 117 |

Section 117 Reportable Amounts in FOIA Files |

Percent of Funds (Dollar Amount) Not Captured By Section 117 |

|---|---|---|---|

|

Obama |

$1.8 billion |

$3.9 billion |

54% |

|

Trump |

$4.7 billion |

$3 billion |

- |

|

Biden |

$1.6 billion |

$2.6 billion |

39% |

Figure 2 shows the top 5 countries for underreporting in our sample. We calculated these amounts by summing all funds reported for each country in the Section 117 sample and in our database sample, and subtracting the Section 117 total from the NAS database total. Because our sample has additional limitations for some universities, we caution that these numbers underestimate the actual level of underreporting.

Of particular importance is that Middle Eastern autocracies such as Saudi Arabia and Qatar are among the top countries for which the Section 117 data represents an incomplete account of funding. In our sample of universities, Section 117 underreports the true funding from Saudi Arabia by more than $400 million, and from Qatar by more than $300 million. These are staggering numbers, and we can only surmise that when expanded to all universities in the United States the amounts would be even larger.

|

Country of Origin |

Amount Underreported |

|---|---|

|

Saudi Arabia |

$423 million |

|

Canada |

$366 million |

|

Qatar |

$344 million |

|

Mexico |

$182 million |

|

Turkey |

$104 million |

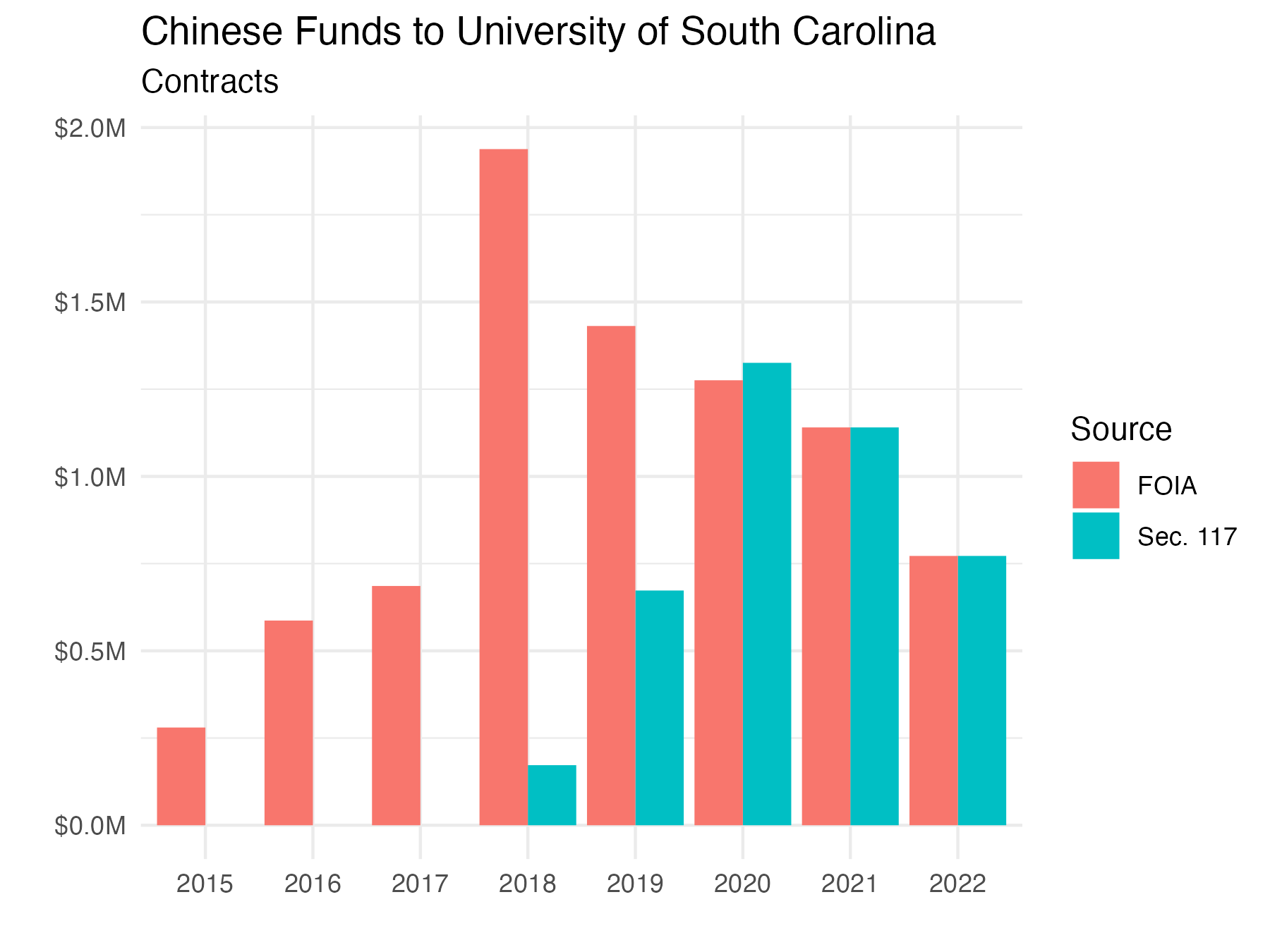

Examining reporting patterns at individual universities further illuminates the consequences of the Trump administration’s enforcement actions. For instance, the University of South Carolina consistently reported its data once it became apparent that nondisclosure could result in harsh scrutiny, even though it was not one of the universities under investigation. Figure 3 shows that the university’s funds from China in our database match well with Section 117 information after the investigation, even during the Biden administration.

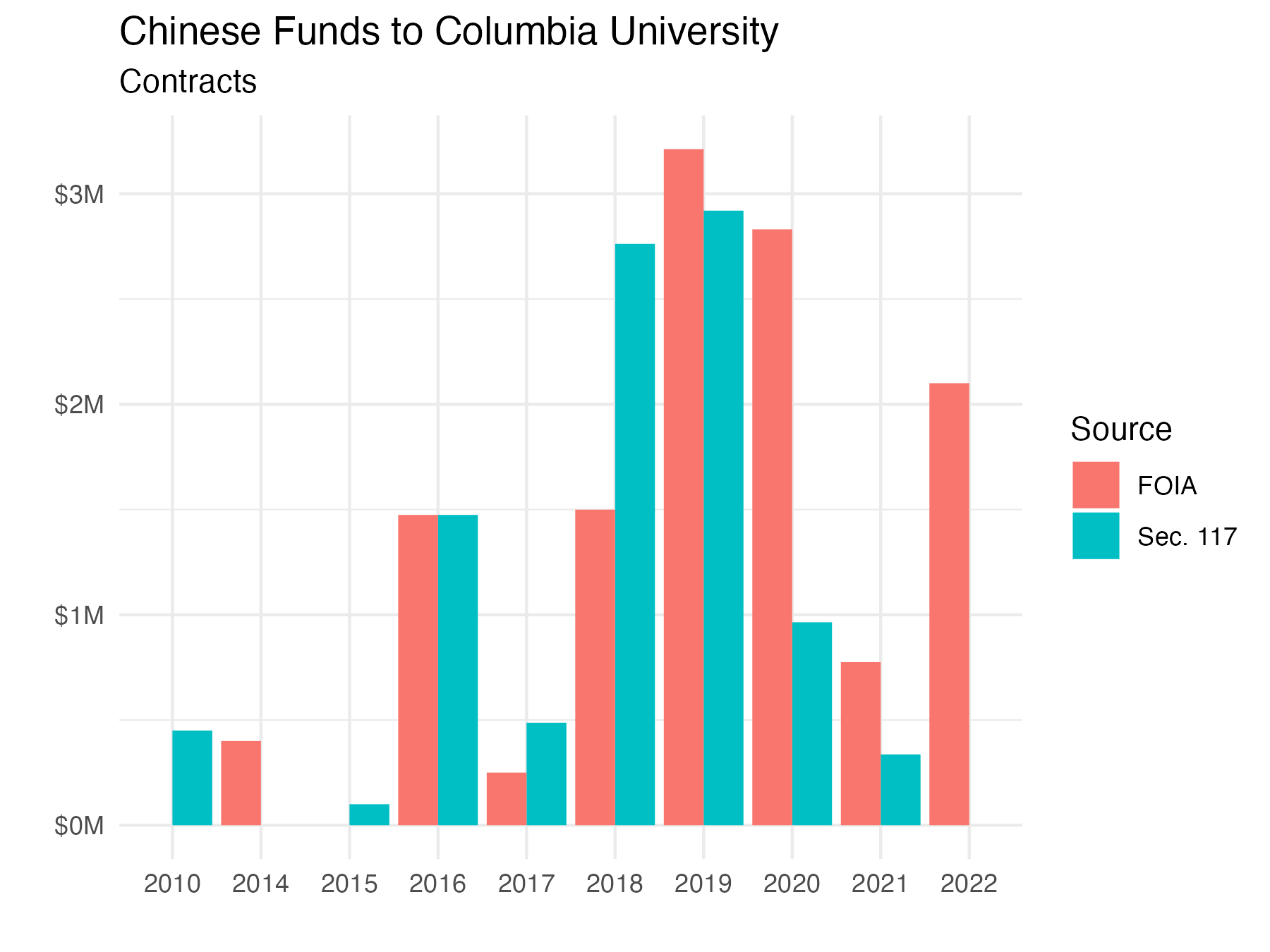

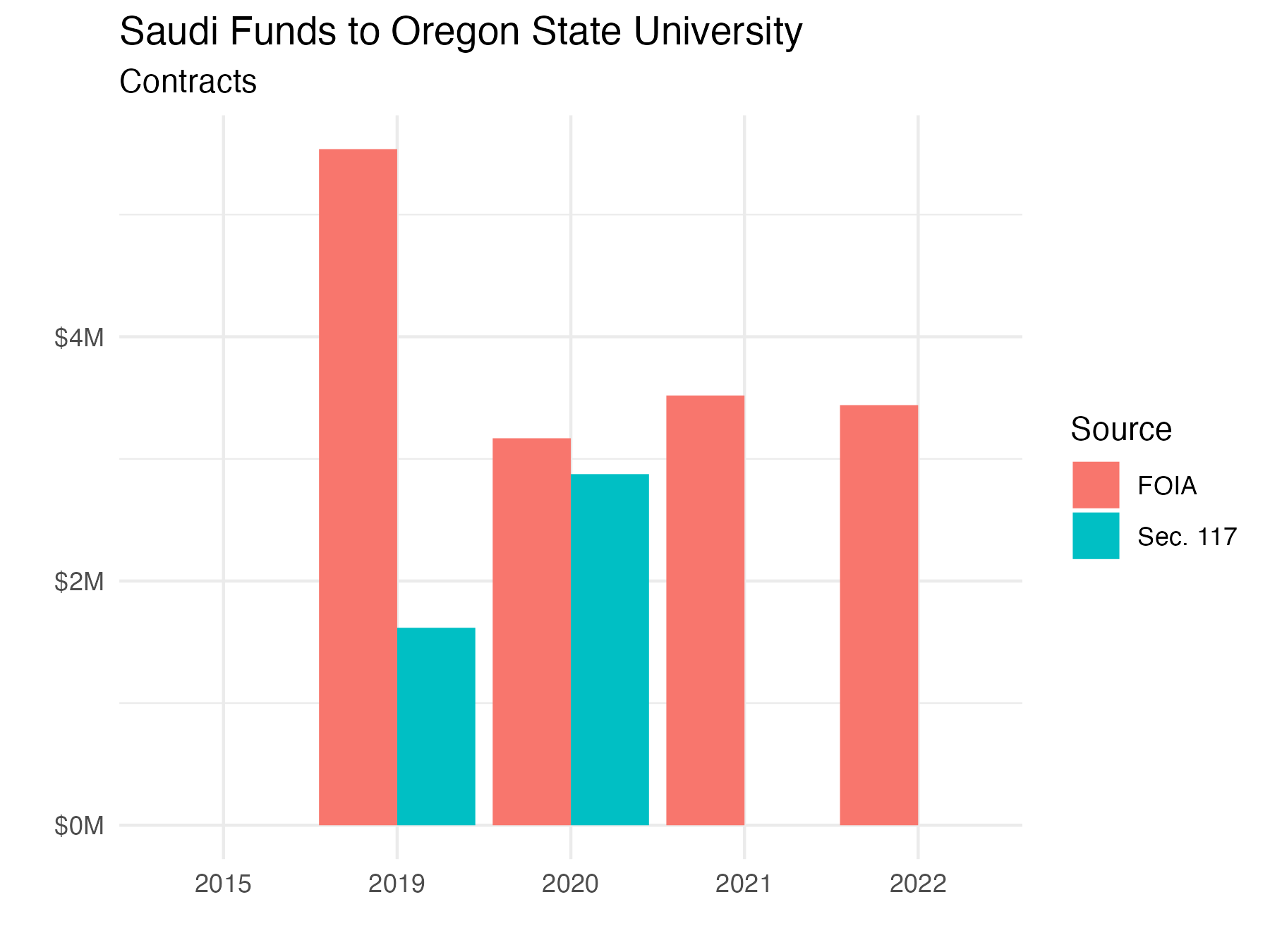

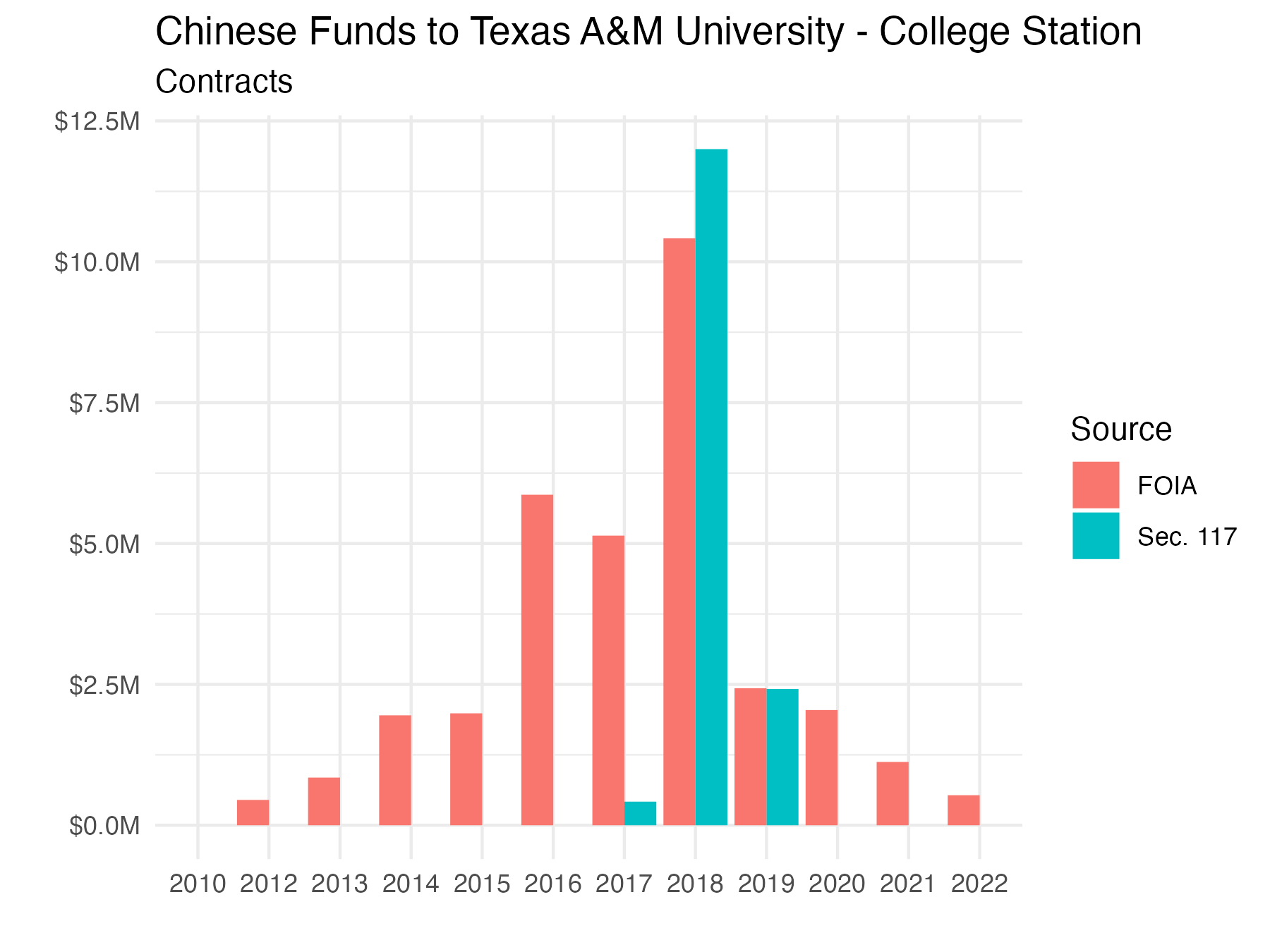

However, once the ED closed its investigations, many universities retruned to their previous habits of underreporting. Figures 4, 5, and 6 show instances of underreporting at Columbia Universitiey, Oregon State University, and Texas A&M University-College Station from 2020 onwards.

Texas A&M’s non-disclosure is perhaps the most egregious instance since it was one of the dozen universities the ED directly investigated. Figure 6 shows how Texas A&M either did not report at all or under-reported the foreign funds they received between 2010 and 2017 from China. By 2018 and 2019, when the university system was under investigation, their Section 117 disclosures increased sharply and even exceeded what is available in our database. But reporting stopped after the COVID pandemic in 2020 and the beginning of the Biden administration in 2021.

Clearly, stronger oversight is needed to ensure universities follow the law on foreign funds disclosure. And this oversight need not be excessive: the Trump administration only investigated a dozen universities, but even other universities not under investigation responded to the threat of investigation by reporting their foreign funds properly. But a one-time revitalization is insufficient. We need continual audits and checks of university compliance, and penalties for non-compliance.

Reporting Threshold

Section 117 currently requires universities to report foreign funds from the same donor totaling greater than or equal to $250,000 in a calendar year. Lawmakers have proposed threshold reductions to capture more foreign funds, but the exact number varies. Some states, like New York and Pennsylvania, require universities to report foreign funds of at least $100,000 per year. Utah has a $50,000 annual threshold. What kind of threshold should be used to capture as many funds as possible while minimizing the reporting burden on universities and the government?

Figure 7 shows that the current $250,000 annual threshold captured 92% of the dollar amount of foreign funds that went to universities within our sample, or $9.7 billion. Reducing the threshold to $100,000 provides the largest increase, capturing 5 additional percentage points of funds. Reducing the threshold further will only capture, at most, an additional 2 percentage points of the total foreign funds. That being said, lawmakers would do well to recall that the amount of money in a donation is not perfectly correlated with its level of potential harm or security threat. While very little in terms of dollar amount can be found lower than $100,000, over 40% of the transactions fall into this range.

|

Threshold |

Amount |

Percent |

|---|---|---|

|

< $50K |

$136 million |

1% |

|

$50K-$100K |

$132 million |

1% |

|

$100K-$250K |

$556 million |

5% |

|

≥$250K |

$9.7 billion |

92% |

Figure 8 shows the top five countries that gave the most funding to universities within each threshold category. Countries within the category reporting $250,000 or above usually fund multi-year research projects and student tuition through massive government programs. Qatar’s gifts disproportionately affect the six American universities with branch campuses in the Gulf State. These funds both support the operation of the branch campuses and provide lucrative research grants to their faculty.

Notably, China appears as a top country of origin across all thresholds. One would need to lower the threshold almost to zero to capture the full extent of China’s influence in American universities.

|

Threshold |

Country #1 |

Country #2 |

Country #3 |

Country #4 |

Country #5 |

|---|---|---|---|---|---|

|

< $50K |

China |

Canada |

South Korea |

United Kingdom |

Japan |

|

$50K-$100K |

South Korea |

United Kingdom |

Canada |

Japan |

China |

|

$100K-$250K |

United Kingdom |

China |

Japan |

South Korea |

Canada |

|

≥$250K |

Qatar |

Germany |

China |

Saudi Arabia |

United Kingdom |

One way to accomplish this while keeping compliance manageable is to require universities to report all amounts from a specific set of countries and impose a reporting threshold for others. The Deterrent Act takes this approach, requiring full reporting from “countries of concern.”29

Recommendations

We provide four recommendations under two categories of transparency and enforcement.

Transparency Measures:

- Make donor names accessible to the public

- Make each gift’s purpose accessible to the public

Although our database provides this information for most gifts, federal regulation is the only way to make this information universally available by transcending various state restrictions on public records requests.

Enforcement Measures:

- The ED should audit a select number of universities every three years

The ED should conduct regular audits to ensure that universities are in compliance with foreign funds disclosure requirements. Every three years, the ED should randomly select 25 universities for an audit, using a stratified sampling procedure that groups universities by endowment size and their previous history of accepting foreign funds. Government officials should more frequently sample large endowment universities and universities with a history of significant foreign funding. The audit results should be made publicly available online. The random audit will provide an additional incentive for universities to comply with foreign funding requirements.

- Penalize universities which fail to follow the law

Transparency measures are only effective if universities are incentivized to disclose their foreign funds. For each unreported item to Section 117, lawmakers should set a fine of above 100% of the value of the gift or contract along with a minimum penalty (e.g., Pennsylvania law 24 P.S. 6301-6307 imposes a civil penalty of 105% of the amount for each undisclosed report). Subsequent violations should result in harsher penalties. The rigid structure of this fine avoids giving enforcement bodies excessive discretion. In other words, it prevents lax bureaucrats from imposing low fines to protect the interests of higher education lobbying groups.

1Eli Lake, “Qatar’s War for Young American Minds,” Free Press, October 24, 2023, https://www.thefp.com/p/qatars-war-for-young-american-minds.

2Neetu Arnold, Outsourced to Qatar, National Association of Scholars, September 12, 2022, https://www.nas.org/reports/outsourced-to-qatar.

3Neetu Arnold, Outsourced to Qatar, National Association of Scholars, September 12, 2022, https://www.nas.org/reports/outsourced-to-qatar.

4Neetu Arnold, “Texas A&M’s Unreported Foreign Funding,” Wall Street Journal, June 17, 2022, https://www.wsj.com/articles/texas-am-foreign-funding-underreporting-research-qatar-russia-china-influence-university-11655478764.

5“Texas A&M-Qatar Campus to Close By 2028,” TAMUS System News, February 8, 2024, https://news.tamus.edu/texas-am-qatar-campus-to-close-by-2028/.

6These numbers come from comparing reported funds from Qatar to Texas A&M University in the April 2017 version of the Section 117 database to the June 2021 version. To calculate pre-2017 funds in the 2021 database, we select funds whose receipt date was between 2010 and 2016, inclusive (the earliest funds in the 2017 version were from 2010). If the receipt date was unavailable, we apply the same date range restriction to the contract start date.

7Rachelle Peterson, Outsourced to China, National Association of Scholars, April 5, 2017, https://www.nas.org/reports/outsourced-to-china.

8Neetu Arnold, “Carnegie Mellon Isn’t Being Open About It’s Relationship With Qatar,” Pittsburgh Post-Gazette, April 18, 2024, https://www.post-gazette.com/opinion/guest-columns/2024/04/18/carnegie-mellon-qatar-funding-disclosure-transparency/stories/202404180035; Neetu Arnold, “TikTok’s Secret Effort to Influence American Higher Education,” National Review, September 5, 2023, https://www.nationalreview.com/2023/09/tiktoks-secret-effort-to-influence-american-higher-education/; Neetu Arnold, “Texas A&M’s Unreported Foreign Funding,” Wall Street Journal, June 17, 2022, https://www.wsj.com/articles/texas-am-foreign-funding-underreporting-research-qatar-russia-china-influence-university-11655478764.

9Peter Wood, “‘Phooey on FOIA,’” American Conservative, June 28, 2023, https://www.theamericanconservative.com/phooey-on-foia/;23FC:0065: Neetu Arnold/University of Northern Iowa; University of Northern Iowa Foundation- Acceptance Order, Iowa Public Information Board, August 17, 2023, https://ipib.iowa.gov/23fc0065-neetu-arnolduniversity-northern-iowa-university-northern-iowa-foundation-acceptance-order.

10Section 117 Foreign Gift and Contract Reporting, Office of Federal Student Aid, U.S. Department of Education, accessed August 29, 2024, https://fsapartners.ed.gov/knowledge-center/topics/section-117-foreign-gift-and-contract-reporting.

11Institutional Compliance with Section 117 of the Higher Education Act of 1965, Office of the General Counsel, U.S. Department of Education, October 2020, https://www2.ed.gov/policy/highered/leg/institutional-compliance-section-117.pdf.

12(GENERAL-24-79) Reminder – July 31 Reporting Deadline for Section 117 of the Higher Education Act of 1965; Decommission of the Section 117 Interactive Data Table, Office of Federal Student Aid, U.S. Department of Education, June 26, 2024, https://fsapartners.ed.gov/knowledge-center/library/electronic-announcements/2024-06-26/reminder-july-31-reporting-deadline-section-117-higher-education-act-1965-decommission-section-117-interactive-data-table.

13Neetu Arnold, “Foreign Donor Database,” National Association of Scholars, August 15, 2024, https://www.nas.org/foreign-donor-database.

14Some of these variables will only appear if users download the entire file.

15A small number of institutions in our database do not have an OPEID, because they are state agencies that belong to a university system rather than universities. Examples include Texas A&M Engineering Experiment Station (TEES) and Texas A&M Agrilife Research.

16Most universities do not report such an identifier. For those that do, we have retained the identifier, unedited, for reference.

17We have made some edits to this variable relative to what the universities report to improve consistency across the different data sources. For instance, when a corporation is the source of funds, we attempt to identify the country where its ultimate parent is headquartered and use this as the country of origin. However, this was not possible to do for all donations in our database, and we therefore recommend that 1) users interpret this variable in the context of the donor name to obtain a fuller picture of the donation’s origin, and 2) users exercise caution in interpreting this variable when the donor name is not present or is ambiguous.

18“Contracts” include both research grants to faculty and contracts with the university administration, such as for the operation of a foreign branch campus. “Gifts” are funds from a donor that may be restricted, but are not tied to a specific project. Student tuition payments may originate from individual students and families or they may be paid by foreign organizations on behalf of foreign students. Note that the ED does not use the same transaction types as we do in our database. The most important difference is that they do not specify when payments are for student tuition; usually they are described as “restricted contracts.”

19Section 117 Foreign Gift and Contract Data, Office of Federal Student Aid, U.S. Department of Education, https://fsapartners.ed.gov/knowledge-center/topics/section-117-foreign-gift-and-contract-reporting/section-117-foreign-gift-and-contract-data.

20Paul R. Moore, “The Education Department Should Reverse Its Decision and Provide Real-Time Access to University Foreign Funding Disclosures,” RealClearEducation, July 15, 2024, https://www.realcleareducation.com/articles/2024/07/15/the_education_department_should_reverse_its_decision_and_provide_real-time_access_to_university_foreign_funding_disclosures_1044646.html.

21Yuichiro Kakutani, “Star American Professor Masterminded a Surveillance Machine for Chinese Big Tech,” Daily Beast, August 22, 2022, https://www.thedailybeast.com/university-of-maryland-professor-dinesh-manocha-built-surveillance-machine-for-chinas-alibaba.

22Neetu Arnold, Outsourced to Qatar, National Association of Scholars, September 12, 2022, https://www.nas.org/reports/outsourced-to-qatar.

23Yaqiu Wang, “The Problem with TikTok’s Claim of Independence from Beijing,” The Hill, March 24, 2023, https://thehill.com/opinion/technology/3916140-the-problem-with-tiktoks-claim-of-independence-from-beijing/.

24U.S. Department of Education Office of the General Counsel, “Institutional Compliance with Section 117 of the Higher Education Act of 1965,” October 2020, https://www2.ed.gov/policy/highered/leg/institutional-compliance-section-117.pdf.

25In many states, university donor information is held in a legally separate nonprofit foundation. State public records laws disagree on whether these foundations are subject to public records requests, which is a primary source of friction for obtaining university donor information. However, some states that subject university foundations to public records requests still exempt donor identities. See Alexa Capeloto, “Why Some Public Universities Get to Keep Their Donors Secret,” The Conversation, January 10, 2020, https://theconversation.com/why-some-public-universities-get-to-keep-their-donors-secret-129309.

26Neetu Arnold, “TikTok’s Secret Effort to Influence American Higher Education,” National Review, September 5, 2023, https://www.nationalreview.com/2023/09/tiktoks-secret-effort-to-influence-american-higher-education/.

27“Mars Petcare’s research institute rebranding reflects pet science focus,” Veterinary Practice News, December 4, 2019, https://www.veterinarypracticenews.com/mars-petcares-research-institute-rebranding-reflects-pet-science-focus/.

28Note that this procedure requires accurate reporting of the donor names, to which we perform minimal cleaning. If there are typos in donor names, this procedure will inaccurately assume that donations with different donor name spellings are from different donors. This means our estimates of underreporting are conservative, because the procedure is biased toward making the totals look smaller than they are. However, universities generally report the donor name identically across gifts, so we believe this bias to be small.

29“Steel, Foxx Bill Will Deter Foreign Adversaries’ Influence in Postsecondary Education,” Committee on Education & The Workforce, October 11, 2023, https://edworkforce.house.gov/news/documentsingle.aspx?DocumentID=409661.